Credit cards can be powerful financial tools when used wisely. They build your credit score, offer rewards, and provide financial flexibility. But when used incorrectly, they can lead to debt traps, high interest payments, and long-term financial stress.

In 2025, banks are offering more digital credit cards, and competition between issuers is driving better rewards programs. However, the mistakes cardholders make remain the same — and they can cost you thousands of dollars.

This guide covers the top 10 credit card mistakes to avoid, along with practical steps to stay financially healthy.

Disclaimer: This content is for educational purposes only. Always seek professional financial advice for personal credit matters.

1. Only Paying the Minimum Balance

- Why It’s a Mistake: Paying only the minimum keeps you in debt for years while interest piles up.

- Smart Move: Pay the full balance whenever possible. If you can’t, pay more than the minimum to reduce interest costs.

2. Maxing Out Your Credit Card

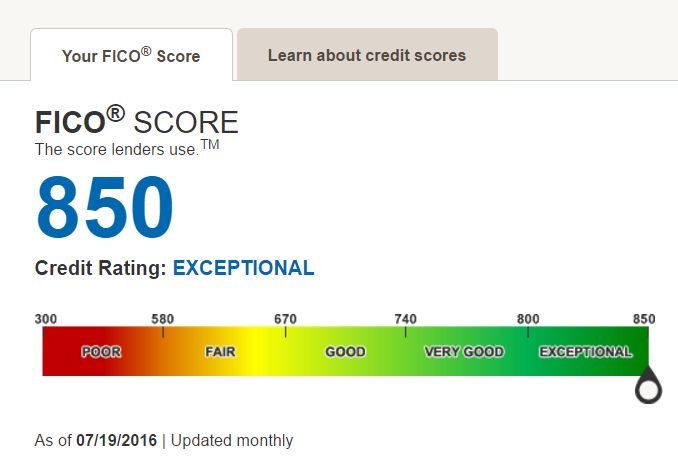

- Why It’s a Mistake: High credit utilization (using 80–100% of your limit) damages your credit score.

- Smart Move: Keep utilization below 30% — ideally 10%.

3. Ignoring Your Credit Report

- Why It’s a Mistake: Errors in your credit report can lower your score and cost you loan approvals.

- Smart Move: Check your report at least once a year. You can dispute errors for free.

See How to Improve Your Credit Score in 2025.

4. Applying for Too Many Cards at Once

- Why It’s a Mistake: Each application triggers a “hard inquiry,” lowering your score temporarily.

- Smart Move: Space out applications and only apply for cards that fit your financial needs.

5. Missing Payments

- Why It’s a Mistake: Payment history makes up 35% of your credit score. Missing just one payment can stay on your report for 7 years.

- Smart Move: Set up automatic payments or reminders to stay on track.

6. Falling for Rewards Traps

- Why It’s a Mistake: Chasing rewards often leads people to overspend, wiping out the benefits.

- Smart Move: Use credit cards for planned expenses only, not impulse purchases.

7. Taking Cash Advances

- Why It’s a Mistake: Cash advances come with immediate high interest rates (20–30%) and fees.

- Smart Move: Avoid using your card for cash withdrawals unless it’s a true emergency.

8. Ignoring Interest Rates (APR)

- Why It’s a Mistake: Many people sign up for cards without understanding the APR. Carrying a balance on a high-APR card can be financially devastating.

- Smart Move: Compare credit cards before applying. → See Loans: Personal vs Payday Loans in 2025.

9. Closing Old Accounts Too Soon

- Why It’s a Mistake: Closing long-standing accounts lowers your average credit age and hurts your score.

- Smart Move: Keep older accounts open (even if you don’t use them much) to build credit history.

10. Not Having an Emergency Fund

- Why It’s a Mistake: Many people use credit cards as their “emergency fund,” which leads to high-interest debt.

- Smart Move: Build savings instead. → See The Importance of an Emergency Fund in 2025.

Smart Credit Card Practices in 2025

- Always pay bills on time.

- Use no more than 30% of your available limit.

- Leverage rewards without overspending.

- Review statements monthly for fraud or errors.

- Pair credit card use with a budgeting system → How to Save Money on a Tight Budget in 2025.

Conclusion

Credit cards can either work for you or against you. Avoiding these 10 mistakes will help you build a stronger credit score, save money on interest, and achieve long-term financial stability.

The key is discipline and awareness — if you use credit wisely, it can open doors to better loan approvals, higher credit limits, and financial freedom.

Related Articles You May Like:

- Mortgages & Refinancing in 2025: Everything You Need to Know

- Retirement Planning in 2025: Secure Your Future Today

Personal Loans vs Payday Loans in 2025

Pingback: Auto, Health and Life Insurance in 2025: Complete Guide - moneypathway.blog